Digital marketing essentials for China

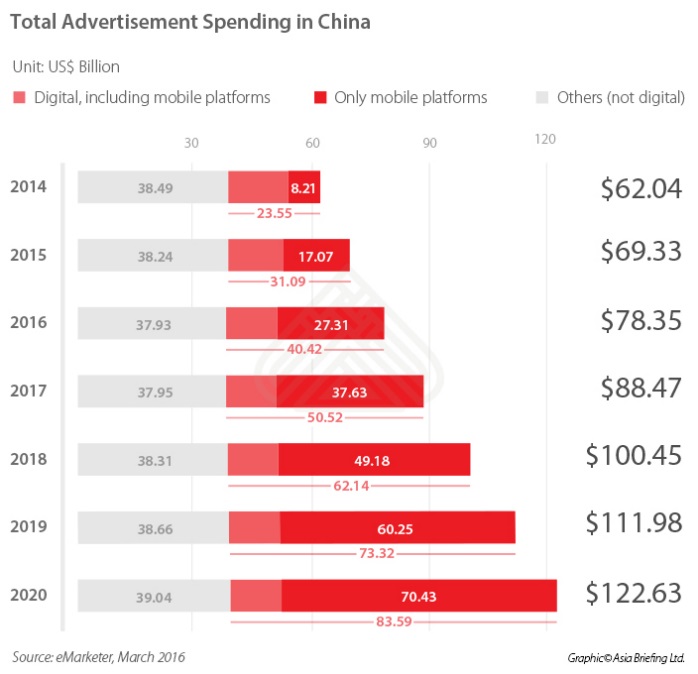

As of June 2016, China has approximately 710 million internet users. Experts expect this number is to almost double within the coming 10 years as the rest of the country comes online. As such, digital advertisement spending is seeing a steep increase. It is expected to grow from US$23.6 billion to US$83.59 billion between 2014 and 2020, with the majority spent on mobile platforms.

Text version

Total advertisement spending in China from 2014 to 2020 (Unit: US$ Billion)

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|

| Digital, including mobile | $23.55 | $31.09 | $40.42 | $50.52 | $62.14 | $73.32 | $83.59 |

| (% of total) | 38.0% | 44.8% | 51.6% | 57.1% | 61.9% | 65.5% | 68.2% |

| -Only mobile platforms | $8.21 | $17.07 | $27.31 | $37.63 | $49.18 | $60.25 | $70.43 |

| (% of digital ad) | 34.9% | 54.9% | 67.6% | 74.5% | 79.1% | 82.2% | 84.3% |

| Others (not digital) | $38.49 | $38.24 | $37.93 | $37.95 | $38.31 | $38.66 | $39.04 |

| Total | $62.04 | $69.33 | $78.35 | $88.47 | $100.45 | $111.98 | $122.63 |

Source: eMarketer, March 2016

Major digital advertisement platforms

The three dominant internet players in China are Baidu, Alibaba and Tencent. Together, they made up 60.6%%of all digital ad revenues in 2015, which is expected to increase to 66.8 % in 2018. On mobile platforms, these numbers are even higher, going from 71.1 % in 2015 to a projected 74.4 % in 2018.

Text version

Digital ad revenue share in China from 2015 to 2018, in percentage of total

| 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Baidu | 28.0% | 21.3% | 18.9% | 17.6% |

| Alibaba | 24.8% | 28.9% | 31.6% | 33.7% |

| Tencent | 7.8% | 9.9% | 12.4% | 15.5% |

| Other | 39.4% | 39.9% | 37.2% | 33.2% |

Source: eMarketer, September 2016

Baidu, often called China’s Google, is the largest search engine in the country. Advertising on Baidu is like using Google AdWords and mainly revolves around search engine optimization (SEO) tools. While this process is comparable to using Google AdWords, significant differences exist. Having a Chinese website is essential, as the search engine doesn’t index many non-Chinese pages. Also, hosting a website outside of China will place one at a disadvantage as these are ranked lower on the platform.

Alibaba is China’s e-commerce giant. In 2016, it overtook Baidu as China’s largest digital advertiser, by generating 29 % of the country’s total digital ad revenues. Like Baidu, Alibaba’s largest chunk of advertising revenues come from search engine advertising.

Tencent is the market leader in social media in China. Contrary to Baidu and Alibaba, Tencent does not focus on search engine advertising. Its advertisement revenue is mainly coming from WeChat. Tencent opened WeChat’s Momentsfeature in early 2015. Companies can place advertisements in users’ Moments newsfeed—like ads on Facebook’s newsfeed. Paying popular WeChat bloggers to promote products is another effective way to reach the right audience.

Internet advertising regulation

Over the past several years, the Chinese government has turned its attention toward greater regulation on advertising, and more recently on online advertising. Following in the footsteps of the amended Advertising Law, implemented in 2015, the State Administration of Industry and Commerce (SAIC), advanced interim measures for the administration of Internet advertising—which came into effect on September 1, 2016. The new regulation:

- clarifies what content is considered “internet advertising”

- lays down rules for “publishers” of online advertisements

- outlines investigation measures and penalties for violators

Online advertising in China is everywhere; these regulations will have a widespread impact on the actions of advertisers and platform operators.

Disclaimer:

The Canadian Trade Commissioner Service in China recommends that readers seek professional advice regarding their particular circumstances. This publication should not be relied on as a substitute for such professional advice. The Government of Canada does not guarantee the accuracy of any of the information contained on this page. Readers should independently verify the accuracy and reliability of the information.

Content on this page is provided in part by Dezan Shira & Associates a pan-Asia, multi-disciplinary professional services firm, providing legal, tax, and operational advisory to international corporate investors.